IN THE NEWS

Parcel handling gets a makeover in the ecommerce era

By Bridget McCrea June 1, 2025

The global e-commerce market is going to reach nearly $5 trillion this year—up from $4.2 trillion last year and currently on track to exceed about $5.6 trillion within the next two years, according to a Shopify report. Sold on the convenience of shopping online, consumers continue to flock to the web to buy everything from home goods to cosmetics to furniture, and pretty much anything else that can be picked, packed and shipped quickly and economically.

The e-commerce trend changed how those warehouse processes take place, with the massive uptick in direct-to-consumer (D2C) orders having the most profound impact on fulfillment centers.

Once focused mainly on shipping pallets of goods to distributors, retailers and other entities that worked directly with end users, warehouses are now handling more D2C orders that are driving a global market segment expected to reach $175 billion in 2032—up from just $66 billion in 2023, according to a Market Research Future report.

These are just a couple of shifts that have forced warehouse and DC operators to rethink everything from how products are packaged and stored; how orders are fulfilled; and how those orders are subsequently shipped out the door.

Through it all, parcel has become an increasingly important part of how these facilities ship everything from a single tube of Chapstick sent to a customer’s home to multi-item orders of office supplies for a business buyer.

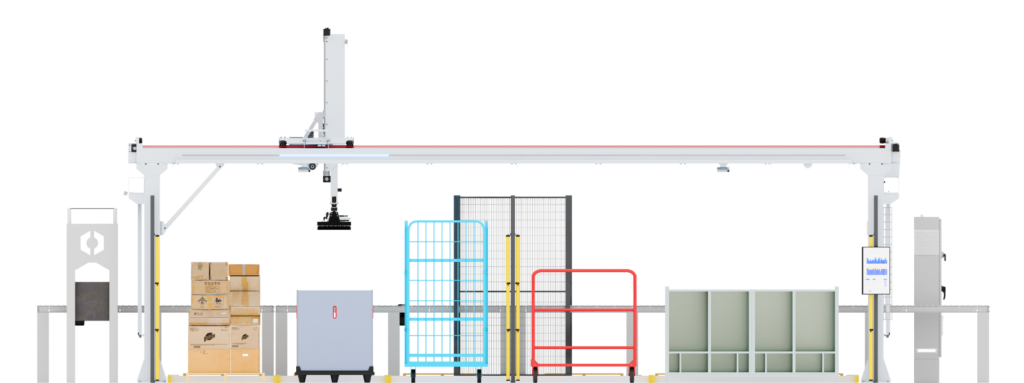

Because these facilities can’t operate profitably with a primary focus on bulk distribution anymore, they need more sophisticated parcel handling capabilities that meet the demands of their individual consumers. They’re using more advanced materials handling systems designed for single-item and small multi-item orders; implementing new tracking and labeling technologies; and continually honing their packing and sorting operations to improve both throughput and efficiency.

It’s a work in progress at this point, being that most of the intense pressure to change came during the Covid years and then stayed in place as the e-commerce marketplace continued to grow. Not to say companies weren’t already working to polish their parcel management skills pre-Covid, when e-commerce was already gathering steam, but the global pandemic definitely accelerated the pace.

Unboxing efficiency

Fast-forward to 2025 and excelling at parcel shipping has clearly become table stakes for organizations that want to thrive in the e-commerce-driven marketplace.

Lucas Watson, chief sales officer of Körber Business Area Supply Chain, Parcel Logistics, North America, says right now he’s seeing a surge in the variety of parcels that operations are sorting and handling. And, that the surge incorporates everything from “bigs to smalls”—meaning, it’s not restricted to any specific parcel or product size.

“We’re seeing a big trend in the range of parcel sizes that the equipment has to sort and singulate,” says Watson. “Companies are also looking for solutions that offer more speed and flexibility, mainly due to customers’ expectations of faster and faster delivery times.”

Companies are also seeking out modular sortation; conveyor; and dimensioning, weighing and scanning systems. The modularity allows them to add new modules in busy areas of their facilities and/or scale down in other areas without having to make any massive, costly changes to their operations.

“Being able to quickly increase and decrease capacity is a big trend we’re seeing right now,” says Watson. “Companies also want to be able to automate non-conveyable handling.” The latter is an especially hot topic right now because non-conveyables comprise a small percentage of sales but require a disproportionately high amount of labor resources for most companies.

“We’re talking about very big, heavy parcels that, when handled manually, may lead to ergonomic issues, injuries and employee burnout,” says Watson. “Lifting heavy parcels isn’t a job anyone likes to do.”

Körber is currently working on projects with multiple customers that want to automate the non-conveyable portion of their warehouses. Some of them want to move away from using a combination of transport conveyors plus 16 employees to handle the work, and are turning to automation for help.

“We’re working on a system that helps companies reallocate about 75% of those employees to other areas of the warehouse, where they’re not bending over to pick up and move heavy parcels all day,” says Watson. “Not only can we automate that process for them, but we’re also helping companies increase throughput because the singulator and the sorters being installed can handle the non-conveyables faster and safer.”

The parcel handling revolution

With e-commerce and other trends pushing fulfillment centers to rapidly evolve their parcel handling capabilities, many are implementing cross-belt sorters that can swiftly divert individual parcels to the correct sortation lane or chute. This equipment helps improve accuracy and speed, both of which are critical in environments that deal with a high volume and variety of parcel sizes and shapes.

Chris Marti, FORTNA’s senior director of business development, says he’s definitely seeing a bigger focus on cross-belt sortation right now. These machines have what FORTNA calls a “high level of destination density,” making them very applicable for DCs that need a wide range of sortation points. Marti is also seeing a bigger focus on both automated storage and retrieval systems (AS/RS) and robotic induction equipment, the latter of which generally has to be matched up with a very specific application to deliver results.

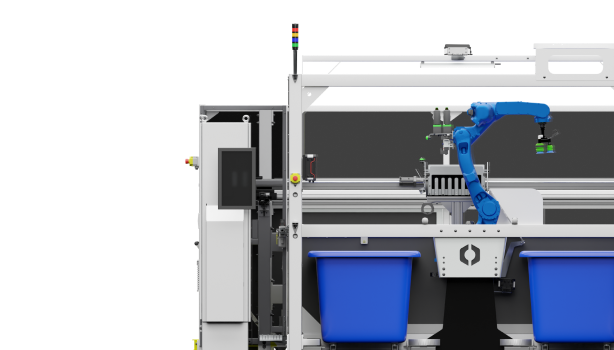

Robotic induction is the automated process of using robots—often equipped with artificial intelligence (AI) and vision systems—to pick individual items or parcels and place them onto a conveyor belt or sorting system for further processing.

“Robotic induction is best for warehouses that deal with similar types of products (size, shape and weight) like baseballs, shoes and/or apparel,” says Marti. “In the parcel environment, however, companies may be shipping everything from baseballs to mufflers, which means average package length and weight are both actually increasing.”

In that variable environment, the technology itself has to be “a bit more agile,” says Marti, to accommodate products of larger size and weight. FORTNA has to factor these points in when coming up with its innovative warehouse designs.

“We look at technology,” he says, “noting any limitations and then either designing to those or designing a bit more buffer into it.”

Automating the process

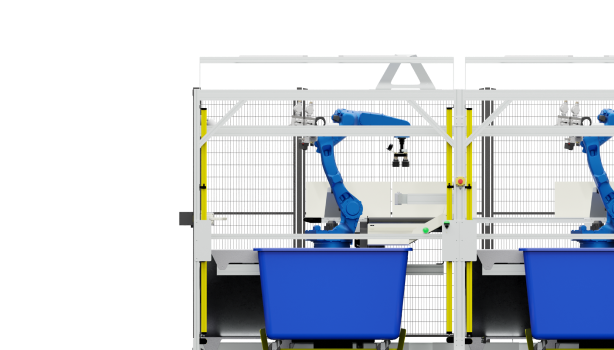

The impact of robotics on parcel handling is multifaceted. Automation of induction, the crucial initial step of introducing parcels onto sorting systems, is just one of many steps currently being revolutionized by robots, AI and other advanced technologies.

Companies are also using robots for sorting, trailer loading and unloading, autonomous picking and packing, and to transport orders to different processing zones.

With the warehouse labor crunch still in full force and expected to continue, more companies will be turning to technology, automation and robotics to help quell their parcel shipping challenges and streamline their operations.

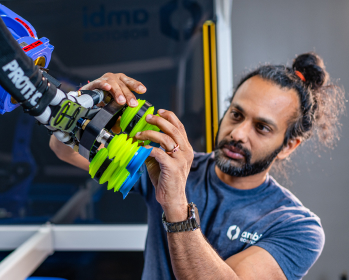

Jeff Mahler, co-founder and chief technology officer at Ambi Robotics, says some of the core advancements in this area involve sortation, induction, and diverting polybags and mailers at very high speeds.

Vision systems also come into play in this realm. “If you can sort de-stack parcels and get them onto a series of belts or side rollers, then those parcels can be simulated with conveyance and vision systems, which is pretty interesting,” says Mahler, who is also seeing more robots being used to load and unload trucks—yet another historically manual task that can create ergonomic issues, injuries and employee burnout.

“These loading and unloading systems are still ‘on their way’ to actually being helpful in the parcel environment,” says Mahler, who sees the sheer variety of parcel types as one roadblock on the path to more automated loading and unloading of trucks.

“We continue to make a lot of good progress as an industry,” says Mahler, whose company makes a variety of secondary-sort parcel sorting (for example, the kind that break parcels out from a chute and into smaller containers) options. The AmbiSort A-Series, for example, is an AI-powered robotic small parcel sorting solution that helps speed up final-mile parcel sortation.

With customers wanting orders faster than ever, and with companies looking to cut the costs associated with getting those orders out the door on time, Mahler expects to see more organizations investing in technology that helps them ship parcels faster, more accurately and more economically. “

Fast delivery at lower costs will continue to be the driving force that creates competitive advantage for certain companies,” Mahler predicts.

“We’ve also reached a point where investing in automation can help increase reliability and accuracy, especially in terms of previously manual processes that can be prone to a package going to the wrong place or employees being overwhelmed by the volume of packages that they have to sort,” Mahler continues. “Automation can definitely help companies address these issues.”